Lastro, a property management platform for Latin America, has raised a $4 million seed round led by Canary. Additional investors included QED Investors – through its early stage fund Fontes – and 1Sharpe Ventures, marking its first investment in LatAm.

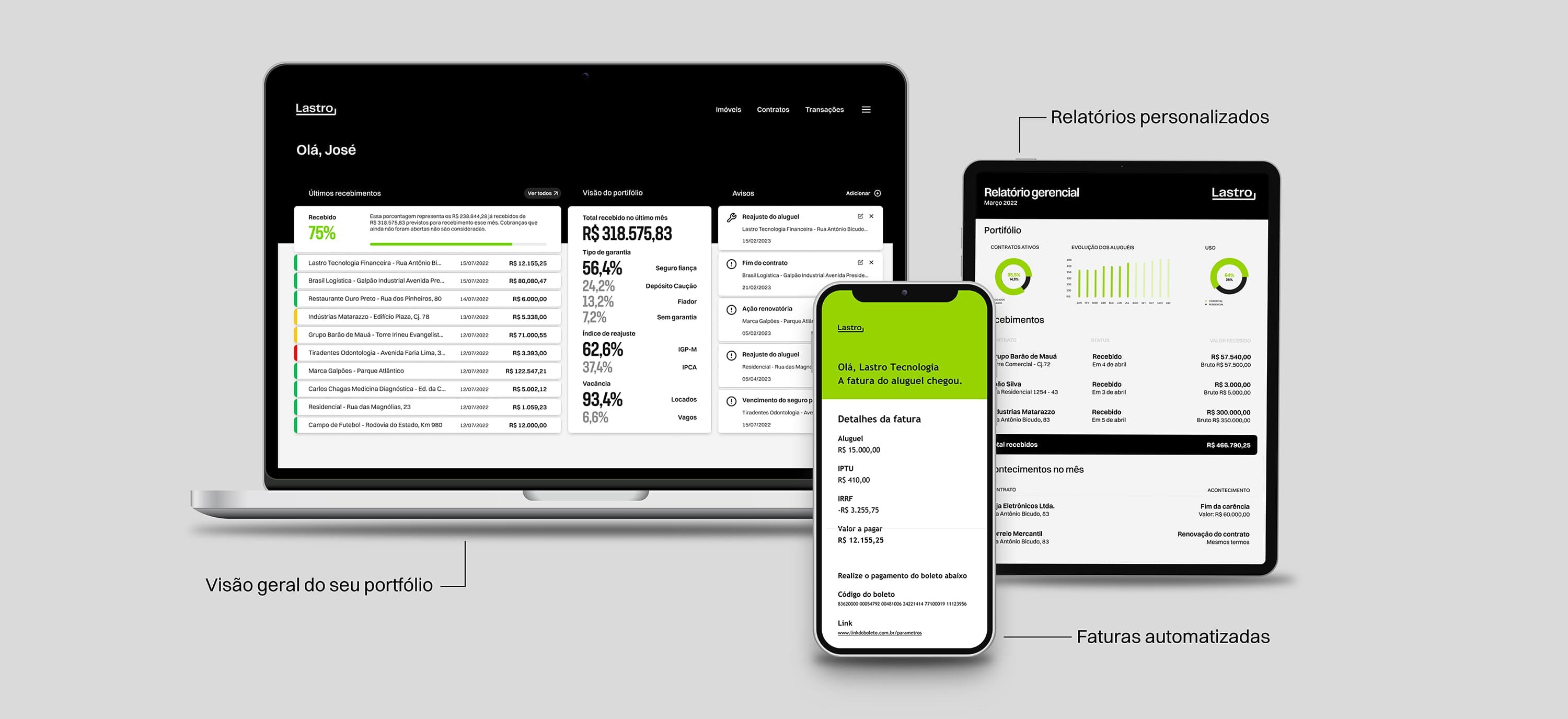

Lastro’s all-in-one property management platform simplifies rental management for landlords and property managers. The web-based platform offers tools that help streamline day-to-day workflows, centralizing property information and facilitating rent collection and expense payments. With Lastro, landlords and property managers are empowered by a vertical SaaS solution with an integrated financial platform to manage their portfolios in a simpler and more efficient way, upgrading from legacy tools such as spreadsheets, outdated software, and manual financial and accounting routines.

“We use software and banking integrations to streamline everything that a property manager needs to do on a recurring basis, thereby cutting costs and freeing up time which can be spent on more value-add tasks,” said Lastro co-founder Allan Paladino.

As the platform develops, Lastro plans to build software solutions catered to transactions beyond property management, such as buying, selling, and financing properties. Lastro’s focus is to build the tech and payments infrastructure for the broader real estate industry and become the de facto operating system. “It’s what Yardi would look like if it were built in 2022 - more open architecture, integrated financial solutions, and extremely user-friendly,” says co-founder José Thomaz Pereira.

In its early days, Lastro will be focused on the Brazilian rental market which lacks an incumbent property management software platform. By starting and scaling in a market like Brazil where switching costs from current solutions are smaller, Lastro’s founders aim to build a platform that can eventually be exported to more mature markets.

Lastro founders include Allan Paladino, who previously worked at Credit Suisse and Brazilian co-working operator Gowork; José Thomaz Pereira, who was previously part of the Blackstone real estate private equity team in LatAm and Asia; Pedro Milanez, who was Nubank’s first hire and its Head of Credit Card Operations; and Alain Michel, who founded a pet retail chain in Brazil.

Looking to continue enhancing the product and boost growth, the company brought three venture capital funds with complementary backgrounds on board. The Brazilian fund Canary is one of the largest in Latin America, with US$230 million under management, and has a vast network and knowledge base around the Brazilian market. QED Investors specializes in fintech, and its portfolio includes other Brazilian startups such as Nubank, Creditas, Loft, and QuintoAndar. Finally, 1Sharpe Ventures specializes in early stage proptech companies, and its partners have founded and backed successful proptech businesses including Roofstock, Lessen, Dwell Finance, and Azibo.

Canary partner Marcos Toledo said, “We invested in Lastro in the company’s early days, and it is exciting to see how much the founders complement each other. They’re using their experience and talent to transform how the real estate market operates, increasing efficiency and creating value for the entire chain.”

——

About Canary

Canary is a venture capital firm focused on being the first institutional investor in startups in Latin America. It was founded in 2017 by entrepreneurs: Mate Pencz and Florian Hagenbuch (co-founders of Printi and Loft), Julio Vasconcellos (founder of Peixe Urbano), and Marcos Toledo and Patrick de Picciotto (former partners of the investment management firm M Square). Canary has a team of 20 people and over USD 230 million under management.

About QED Investors

(https://www.qedinvestors.com)

QED Investors is a global leading venture capital firm based in Alexandria, Va. Founded by Nigel Morris and Frank Rotman in 2007, QED Investors is focused on investing in disruptive financial services companies worldwide. QED Investors is dedicated to building great businesses and uses a unique, hands-on approach that leverages its partners’ decades of entrepreneurial and operational experience, helping its companies achieve breakthrough growth. Notable investments include AvidXchange, Bitso, ClearScore, Current, Creditas, Credit Karma, Kavak, Klarna, Konfio, Loft, Mission Lane, Nubank, QuintoAndar, Remitly and SoFi.

About 1Sharpe Ventures

(https://www.1sharpe.ventures)

1Sharpe Ventures connects entrepreneurs to capital, talent and customers across the startup journey. The 1Sharpe Ventures team of experienced entrepreneurs and investors brings a portfolio of properties, debt financing, deep industry relationships, product development partners, and talent networks to a growing class of technology founders tackling opportunities in the built world. For more information, please visit 1Sharpe.Ventures.